28/11/2024

How to pay with Tax-Free Childcare

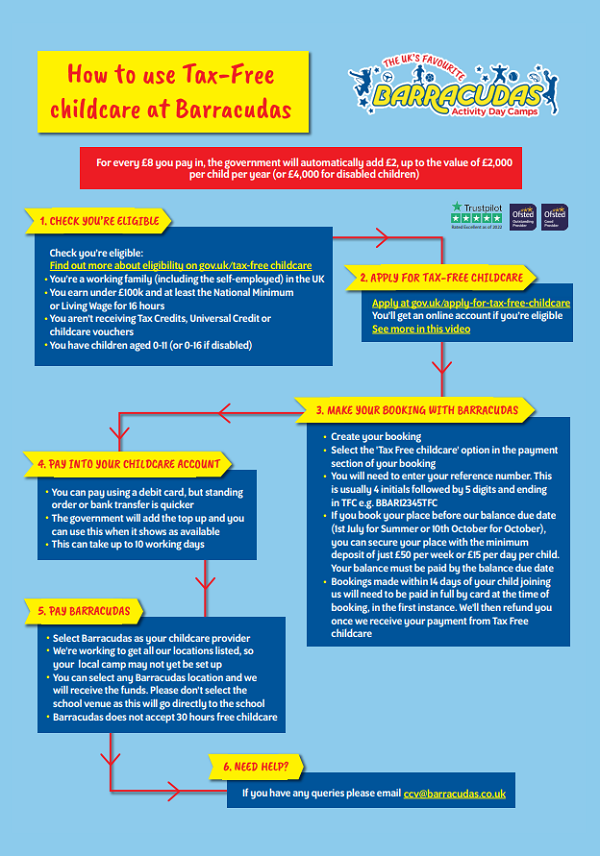

As Barracudas is Ofsted registered, you can use Tax-Free Childcare to pay for your school holiday activities with us. This is just one way we can help make your school holiday childcare affordable.

We also accept Childcare Vouchers and know that many parents use both methods of payment. As Childcare Vouchers are no longer offered to new employees, if you’ve started a new role since 2018 you won’t have this option.

Whilst Tax-Free Childcare is a great option for parents, we know that it’s not completely straightforward setting this up, or using them to pay for childcare providers.

That’s why we’ve created a handy guide for you.

What is Tax Free childcare?

Tax-Free Childcare is a government-backed scheme which offers eligible families up to £2,000 per child per year (or £4,000 for disabled children) free to put towards childcare costs.

The government will give you 20% additional funds for what you pay into your account. For every £8 you pay in, the government will automatically add £2, effectively giving you basic rate tax back on what you spend.

Parents can't claim childcare tax credit (childcare element of working tax) or universal credit if they receive Tax-Free Childcare.

Tax-Free Childcare is available to:

- Working families, including the self-employed, in the UK

- Those earning under £100k and at least the National Minimum or Living wage equal to 16 hours a week

- Those who aren't receiving Tax Credits, Universal Credit or Childcare Vouchers

- Families with children aged 0-11 (or 0-16 if disabled)

Find out more here.

How to use Tax-Free Childcare at Barracudas

Download Barracudas infographic on how to pay with Tax-Free Childcare.

How to register

Parents need to apply or sign into the government childcare service. There is one single application to apply for either the 30 hours free childcare for nursery aged children or Tax-Free Childcare for older children. Please be aware that Barracudas doesn’t accept the 30 hours free childcare.

Find out how to register for Tax-Free Childcare.

How to pay with TFC

We know that it can be a bit confusing when you first start using Tax-Free Childcare to pay for your childcare settings.

We’ve created a handy video to take you through this process.

FAQ’s

What if I already have Childcare Vouchers - can I continue receiving these rather than registering for Tax-Free Childcare?

Yes, but once you’ve stopped using Childcare Vouchers, you only have the option of Tax-Free Childcare. You can continue to use Childcare Vouchers until your employer stops offering them or you change jobs. Parents were only eligible to sign up for Childcare Vouchers up to April 2018 – after that there was only the option of Tax-Free Childcare.

What if I’m registered for Childcare Vouchers but Tax-Free Childcare would be better for me?

Register with Tax-Free Childcare and discuss this directly with your employer.

I can’t find my local Barracudas camp listed as a provider on the government website, what do I do?

You can select any Barracudas Activity Day Camps location listed. We are in the process of setting each camp location up with Tax-Free Childcare, but unfortunately this can take some time. The funds will reach us, whichever Barracudas site you choose. Please do not select the school location as this will not be paid into us.

Am I too late to confirm my booking with Tax-Free Childcare?

If booking within 7 days of the booking start date you will be required to pay by a credit/debit card at the time of booking, in the first instance. You will then be reimbursed once we receive your Vouchers/Tax-Free Childcare. For reimbursement, Childcare Vouchers/Tax-Free Childcare must be received by the end of September 2025 for camps up to and including summer 2025 and the end of October 2025 for October 2025 camps.

It’s certainly not been plain sailing for parents or providers so far but we hope this offers some useful information. For more details, take a look at the government advice.

SEE FULL DETAILS ON PAYING WITH TAX-FREE CHILDCARE & CHILDCARE VOUCHERS